The Sudanese Mineral Resources Company revealed on Wednesday that it is targeting production of 80 tons of gold this year, after seeing nearly a 16% growth in gold output during the first half of 2025.

This ambitious target reflects the increasingly important role of gold in supporting Sudan’s war-battered economy and in financing various factions in the country, especially amid the ongoing internal conflict that erupted in April 2023.

The company’s Director General, Mohamed Taher Omer, stated in an interview with Bloomberg Asharq during the “Egypt Mining Forum” in Cairo that “production exceeded 37 tons in the first half of 2025, compared to 32 tons in the same period last year.”

He explained that Sudan is seeking to regulate the traditional mining sector, which contributes a significant share of the country’s gold production.

The country primarily relies on gold exports for foreign exchange. According to the World Gold Council, Sudan ranks ninth globally and third in Africa, after South Africa and Ghana, in gold production.

Gedaref state in eastern Sudan is among the country’s most important gold-producing regions and contributes foreign currency revenues to the national treasury.

If the planned strategies are implemented, the company’s target could serve as a launching point to solidify Sudan’s gold sector as a key economic driver and help rescue part of the battered economy—even as the national currency weakens and liquidity crises persist.

Combating smuggling, which accounts for nearly 52% of total production, and organizing the market are described as critical factors for turning these goals into tangible benefits for Sudan and its people.

The company announced a strong start to 2025, having produced 13 tons in January and February alone, suggesting the 80-ton target is within reach if current production rates are sustained.

The sector has also seen a rising influx of foreign companies, including Moroccan, Russian, and Jordanian firms, with Qatari enterprises preparing to enter the market—an indication of Sudan’s increasing openness and the government’s bet on international partnerships.

Gold production rose from 42 tons in 2023 to 64 tons in 2024, generating around $1.9 billion from exporting more than 31 tons.

Sudan’s gold output peaked between 2017 and 2022, averaging 107 tons per year, according to previous data from the Sudanese Mineral Resources Company.

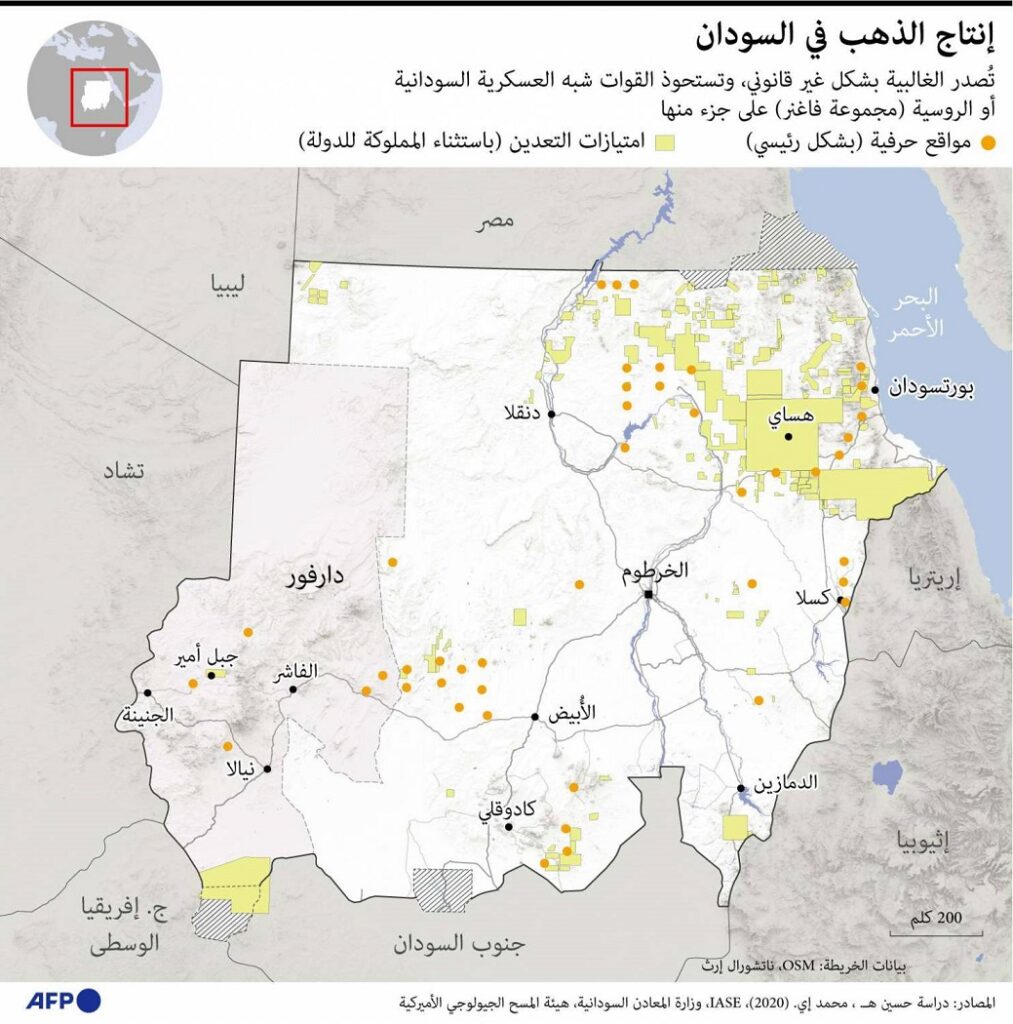

Authorities complain about the inability to accurately determine gold production due to widespread smuggling by individuals, taking place at some 800 sites across the country.

This situation costs the state an estimated $7 billion in lost annual revenue, a sum that could cover all or a significant part of the country’s trade deficit, according to local economic experts.

An unregulated artisanal mining sector dominates most production, which is difficult to account for due to gold selling and smuggling outside official channels—even though Sudan is one of the world’s top producers.

In 2017, the Geological Research Authority of the Ministry of Minerals reported confirmed gold reserves of 533 tons in Sudan, with another 1,100 tons still under assessment.

Five years ago, Sudanese authorities changed the gold trade regulations to allow private sector exports in a bid to fight smuggling and bring in more foreign currency for the liquidity-strapped treasury.

Previously, the Central Bank was the sole legal authority permitted to buy and export gold and establish purchase centers for small mining companies.